What is A Guarantee Income for Life Portfolio?

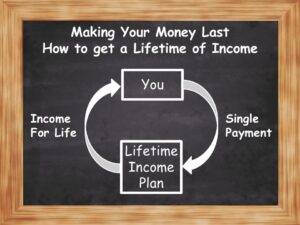

At this point in your life, would you prefer more of a sure thing, or a maybe in retirement, when it comes to an income for life? An income folio is a guaranteed lifetime of Income portfolio. Put another way, it is a portfolio that guarantees you a lifetime income no matter how long you, or you, and your spouse may live, regardless of what is happening on Wall Street.

At this point in your life, would you prefer more of a sure thing, or a maybe in retirement, when it comes to an income for life? An income folio is a guaranteed lifetime of Income portfolio. Put another way, it is a portfolio that guarantees you a lifetime income no matter how long you, or you, and your spouse may live, regardless of what is happening on Wall Street.

Happiness is found with Guaranteed Income for Life

We show people how to help people afford the lifestyle they desire. Our customers are enjoying their golden years, doing what they want to do when they want to do it. They do not worry about outliving their money.

How we can help you

You are probably looking for a way to have ample income to live the life you have dreamed about. And you are probably looking for a retirement based on math and science, not hope and luck. Our typical clients include people:

- Currently retired or nearing retirement.

- Age 59½ or older, even if still working.

- Any age planning to retire within the next 12 months.

- Under 59½ with over $500,000 in liquid assets outside of a retirement plan.

- Seeking a stress-free and worry-free retirement, regardless of what’s happening on Wall Street.

We are experienced professionals

What we do well is:

- show you how you can create pension-like income from your 401K / IRA / TSP or other retirement plan.

- show you actuarially how long your money will last at very conservative rates.

- design an income stream that increases each year with the CPI (consumer price index).

- show you how to do an IRA rollover and create a 100% SURVIVOR BENEFIT for you and your spouse.

Guaranteed Income for Life in the Past:

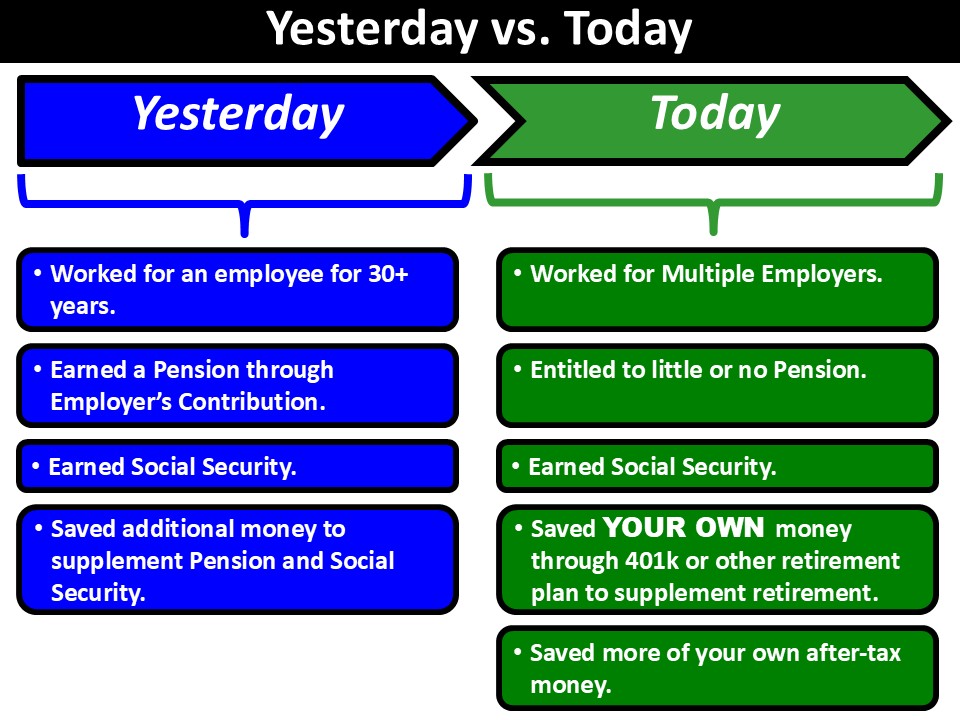

In the past, employees enjoyed a “cradle to grave” Retirement plan. You went to work for one employer for 30 or more years. You earned a pension through your employer’s contribution to your pension and, in most cases, a lifetime pension payment. You earned a Social Security lifetime income payment. And you saved some of your after-tax money for the future.

Happy retirees have Social Security and a pension (If you have a pension)

When you think about the happiest retirees you know, you probably know retired veterans, teachers, firefighters, and other government employees. They have one thing in common: besides receiving a monthly check from Social Security, they also receive a monthly check from a pension. If you are lucky enough to have a pension, what does your pension look like?

- How long will it last?

- Can it go down in value?

- Are you concerned about running out of money?

- Do you have survivor benefits, and if so, how much?

- Is it protective if you have a health event?

- Can we create a pension with your 401(k) or IRA?

If you have a pension, it is a good idea to know the answers to these questions. When you contact us, we walk you through a program that will visit these issues so you are fully informed as to where you are.

Guaranteed Lifetime Income of Today

Today, you may find yourself working for many different employers. Recent studies put this number between 10 and 15. Today most people are entitled to very little or no lifetime payment from a pension plan. You earned a Social Security lifetime income payment. However, today you have to save your own money through 401(k) or 403(b) or another retirement plan. Sometimes with an employer match, sometimes with no match. And you still need to save some of your after-tax money for the future.

Guaranteed Lifetime Income Yesterday vs. today

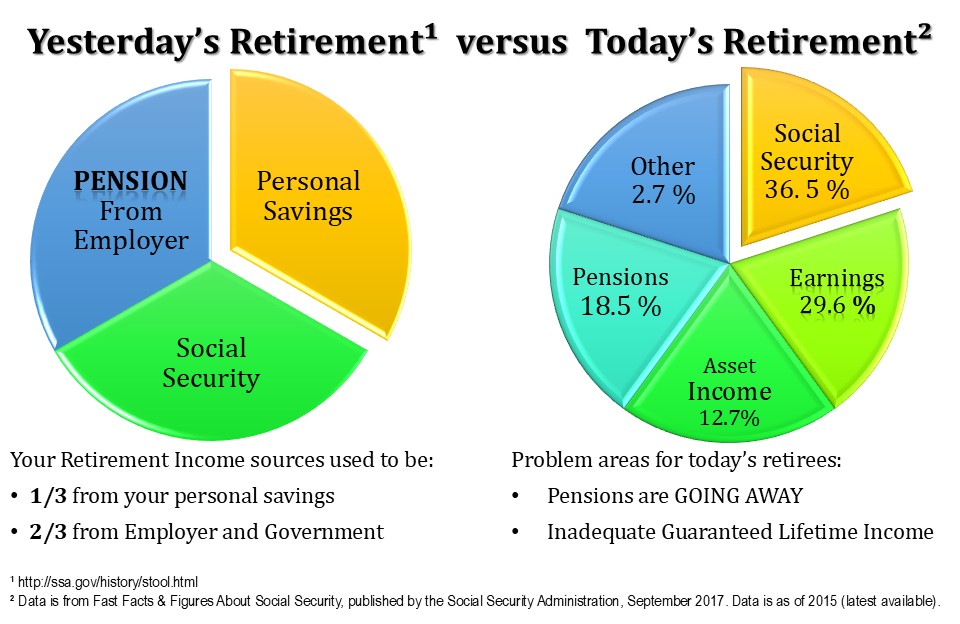

It used to be that 1/3 of your retirement income came from your personal savings, and 2/3 came from your employer and the federal government.

Today it’s a lot different. And for some people, they are still working in retirement (29% of “Earnings”). Our system maps out income scenarios so that when you quit, you know what to expect and can stay retired.

What you are doing now

You probably have a feeling that your retirement plan, as it is, does not seem quite right. You are no longer working or soon will be, and are not certain your current strategy is the best one to get you through retirement. You accumulated your wealth by:

- Working with a financial advisor that you have had for many years. They have helped you build your wealth while you were working and making money. But you are concerned that spending your money might need a different plan than when you were accumulating it.

- Doing it yourself. But when you are no longer working, you do not want the worry and stress of self-managed assets.

- Some combination of both.

Everything that you have done to this point to increase your wealth was the correct thing to do. But when you stop working and need your money to live on, a new plan is needed. The strategies you use to accumulate your wealth are not the same as the strategies used to distribute it as income. Happiness in retirement is based on guaranteed lifetime income, not assets. (NOTE: Look for a link from Hegna for this)

And then the market goes down

When things are bad on Wall Street, your wealth has been reduced while you need the income and you are no longer working, you don’t want to hear:

- Ride out the Market.

- Hang in there.

- Don’t worry, you’re in it for the long run.

- The loss is just short-term and only on paper.

The Ideal Lifestyle:

The ideal lifestyle is a happy one and can be achieved by knowing you have the income to do what you want to do when you want to do it. When you are not working, every day is a Saturday. You can spend time with family and friends. You can go golfing, go out to eat, travel, and do what you want to do.

It’s not about Hope and Luck

When your retirement is primarily based on what is happening on Wall Street, you will likely have a stressful retirement. You might find yourself constantly watching the market to determine if you can take money out or not. In a good market, you might be reluctant to take money out in case the market goes down. In a bad market, you will probably avoid taking money out because the market is down and you can’t spend the money.

When your retirement is primarily based on what is happening on Wall Street, you will likely have a stressful retirement. You might find yourself constantly watching the market to determine if you can take money out or not. In a good market, you might be reluctant to take money out in case the market goes down. In a bad market, you will probably avoid taking money out because the market is down and you can’t spend the money.

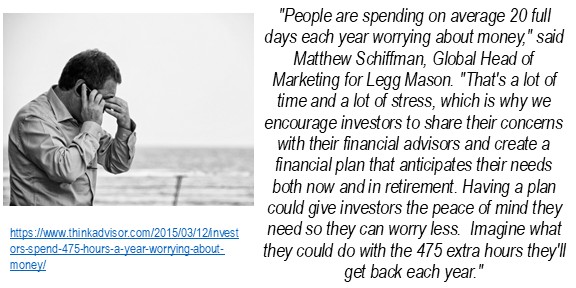

Worry and stress can happen when people rely on their assets, not income in their golden years. When you lose money in the market, many retirees start to adjust their lifestyle to fit their budget. Then they worry whether or not they are going to have enough money for the rest of their life.

Security provides you the freedom to thrive in retirement

An adequately designed Income Folio can provide you the ability to thrive in retirement, no matter hat is happening on Wall Street. Stop worrying about getting there and start enjoying being there. Spend time with those closest to you. This is your time. Time to enjoy your life. Be happy! Let us help you make the most of it.

Services We Provide

Retire Sooner

If you are unsure if you are financially ready to retire, we can help you figure it out.

Inflation Fighter

Protect your purchasing power with Inflation Protected Guaranteed Lifetime Income.

Supplemental Income

Supplement your Social Security and pension with a Guaranteed Lifetime Income Playcheck.

Increase Income and Minimize Taxes

Let us show you ways to increase your income, not your taxes.

Reduce Fees

We may be able to help you reduce the fees you are paying to your other financial professionals.

Plan In Writing

We will give you your plan in writing in easy to understand language.

What is an Income Folio?

What is an Income Folio?

As the markets fluctuate, your peace of mind won’t. An Income Folio gives you the freedom that only security can provide. It provides the freedom to take all those dreams for your future and make them your present.

An income folio is a guaranteed income distribution plan for your wealth when you are no longer working. It is not the same as the accumulation plans you used to build your savings, and works very differently. It’s kind of like the difference between a sure thing and a maybe. It is not about the size of your pile of money, it is about what the money can provide.

Why an Income Folio?

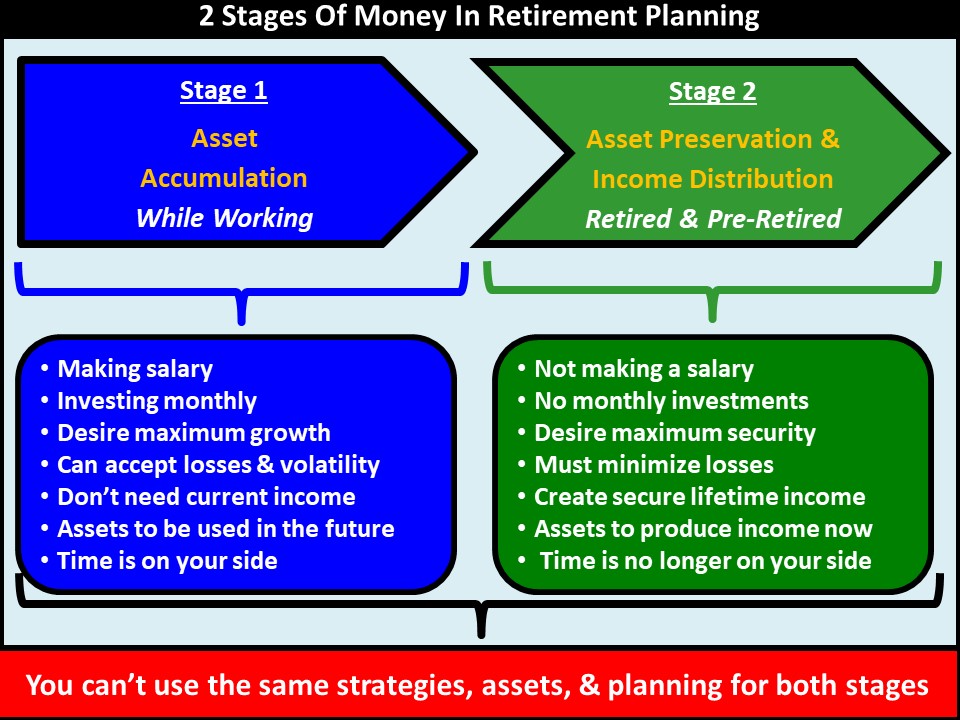

The plan that gets you to retirement is unlikely the plan that will get you through retirement. That’s because instead of saving and investing money, you are now withdrawing and spending it. And that puts a whole different set of pressure and stress on your nest egg. There are two stages of retirement planning and they’re they are distinctively different. You need to understand them.

You stash your cash when you are working

When you’re working, you:

- Are making a salary.

- Are investing money regularly in your 401K or other qualified plan.

- Desire Maximum Growth.

- Can accept losses and volatility.

- Don’t need current income.

- Plan to use your assets in the future.

- Have time on your side.

You are accumulating wealth because you don’t need the income because you have a paycheck. You are younger and time is on your side. During this stage in your life, you should be more aggressive, and you can take greater risks. If you lose money, you have time to recover.

But then you need to change up the game

Within three to five years of retirement, and in retirement, we believe you have to go to asset preservation, what we call income distribution. All of a sudden when you do retire, you:

- Are not making a salary.

- Are not investing money regularly in a retirement plan.

- Desire Maximum Safety.

- Must minimize losses.

- Need to create a secure lifetime income.

- Plan to use your assets to produce income now.

- No longer have time on your side.

You need income, not losses

You must minimize the potential for loss at this point in your life, and you must understand how to create a secure lifetime income. You are going to need to replace your paycheck with income from your retirement savings and make it last as long as you do. If you make a financial mistake, it is very, very difficult to recover.

Wall Steet is Unpredictable

You probably know that that markets will always be volatile and they’re always going to be unpredictable. And when you’re younger and Accumulating assets, you can take that risk because if you lose half your money at age 50, that’s unfortunate, but you still have years to work and recover. You lose half your money at 60 or 65 or 70, you have a real big problem. The strategies that you use, the assets that you select, and the planning techniques between the accumulating assets and income distribution are polar opposites.

We specialize in asset preservation and income distribution

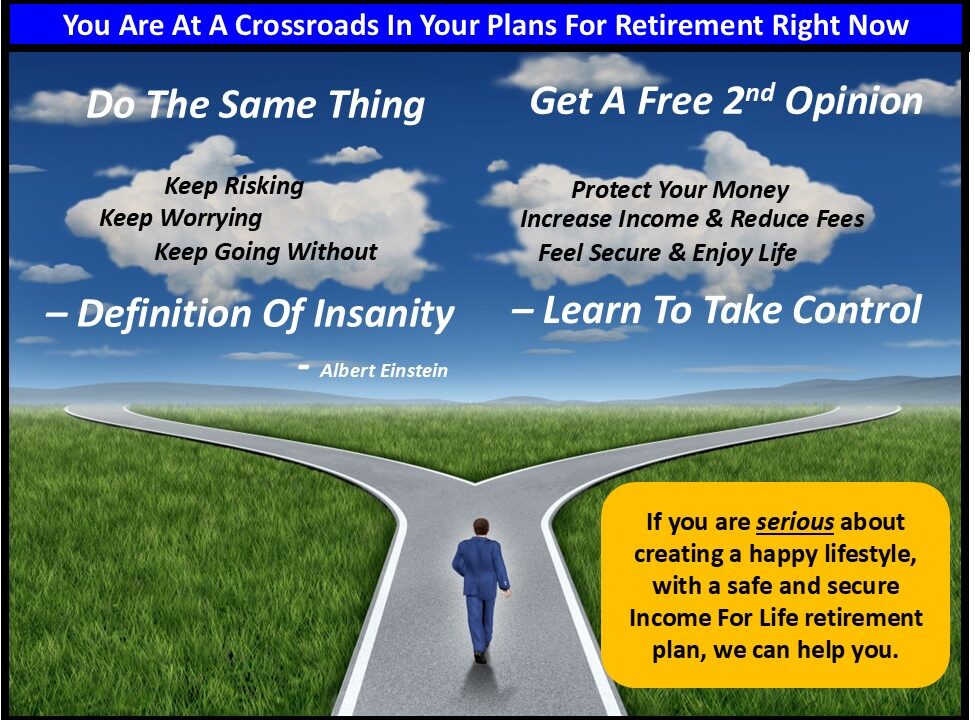

If you are five years before retirement or currently retired, you might be a little disappointed because your broker has not transitioned a portion of your wealth into a distribution plan by now. You may recognize this is a problem because you have no guarantees in retirement.

If you are ready to discuss the distribution of a portion of your assets as a guaranteed lifetime income and would like our help, click here.

Your current advisor

Most advisors are lovely people and are really good at specializing in stage 1, the accumulation of wealth (See Chart). They talk about big returns. They might minimize discussion about the potential risks. They talk about riding out the markets. They talk about hanging in there, saying things like, “Don’t worry about the risk. Everything will eventually come back. Always has, always will”.

And that’s because

The Wall Street propaganda tells us:

- You always have to stay in the market.

- Stay the course.

- It’s going to come back at some point in time.

- Don’t get out.

Many people follow this advice, and there is nothing wrong with that while you are younger and working. But when you are not working, if you stay the course and the markets are going down, and you’re pulling income out at the same time, you’re about to go on vacation and really enjoy yourself; how enjoyable is that going to be when you know you’re losing money and taking money out at the same time? How much stress will you feel?

Many people follow this advice, and there is nothing wrong with that while you are younger and working. But when you are not working, if you stay the course and the markets are going down, and you’re pulling income out at the same time, you’re about to go on vacation and really enjoy yourself; how enjoyable is that going to be when you know you’re losing money and taking money out at the same time? How much stress will you feel?

As a retired person, you need to know that your income is never going to run out and that you’re not taking risks that you don’t understand. You need to control the risk in a portion of your portfolio to have a guaranteed lifetime income plan. So that’s why we stress these two different stages of Retirement planning. And there are very few companies that specialize in Stage 2, Income Distribution, like we do.

We Work With You

With your help, we aim to create a written plan to ensure that you meet and exceed your budget for as long as you live. That way, you can do what makes you happy. If you do not have enough income to cover or exceed your budget, you may find yourself unable to do what makes you happy.

People are Living Longer

Longevity is probably the single most important risk facing retirees. Today, Americans are living longer than ever, resulting in a retirement that can last 25, 30, or even 40 years. We know that if we have a 65-year-old couple, there’s a 50% chance for men to reach age 88 and a 50% chance for women to reach age 90. That means half of the 65-year-olds will live even longer. In fact, one out of four will live to their mid-90s, and 5% will live to 100 or older. (Life expectancies are based upon the 2012 IAM Basic Mortality Table).

https://www.statista.com/statistics/996619/number-centenarians-us/#:~:text=This%20statistic%20shows%20the%20number,589%2C000%20in%20the%20year%202060 In the United States today, there are 92,000 Americans who are age 100 or over. And it’s expected that the number of centenarians will double in the next 20 years to about 190,000.

The reality is that we’re living longer, and retirement for many of us could be much longer than we ever anticipated. Living longer is the most critical risk facing retirees. The longer you live, the better the chances are you will run out of money due to inflation, a chronic health condition or a sudden loss of savings.

The solution is here.

We have a method to map out not only your retirement income but, more importantly, answers questions like:

- What if he goes first?

- What if he passes today, five years from now, 10 years from now, 15 years from now, 20 years from now, what’s going to happen?

- What is the survivorship income going to look like for her?

- What if she goes first?

- What if she goes today, five years from now, 10 years from now, 15 years from now, 20 years from now, what is his income going to look like?

And when we map it out, you’ll be able to see in black and white where you have any potential holes.

How do we do it?

We created a simple process where we:

- Provide you with our data form.

- Map out your Social Security benefits statement pages (www.ssa.gov/myaccount)

- Look at any pension information, and any pensions that you’re entitled to.

- Look at your 401(k)s, IRAs, 403(b)s, TSPs, and any other retirement plans.

- Review any non-IRA account statements that you have.

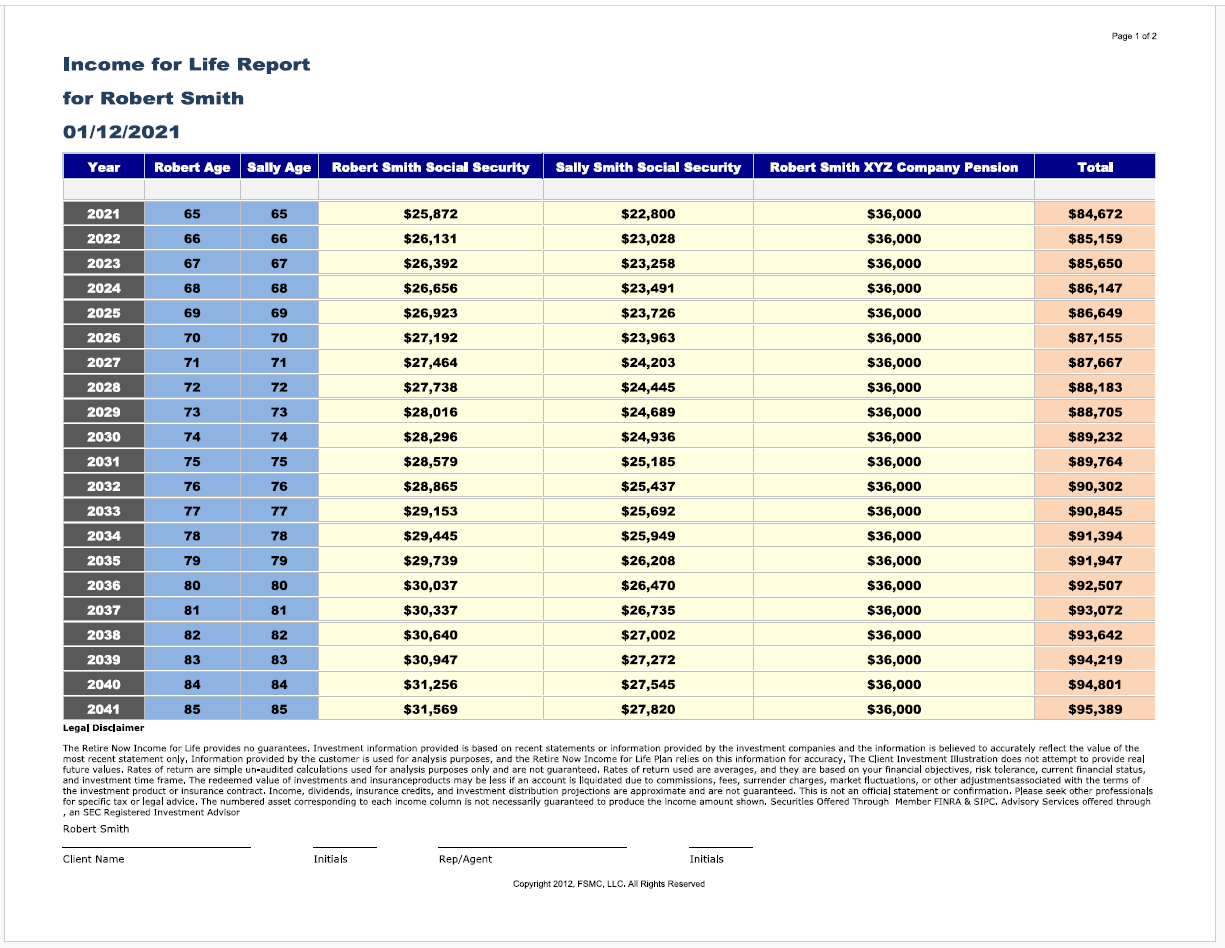

With that information, we create an Income For Life spreadsheet. We put your numbers in, and we can actually show you exactly what your income’s going to be each year for the rest of your life. When presented with an Income for Life Report, many people say it is the first time they’ve ever seen it laid out quite like this. Also, it makes it so clear (and simple) where their income is likely to come from during their retirement.

It is almost like having more Social Security or a pension

An Income Folio based on your Income For Life Report will provide you with guaranteed income for as long as you live, either as a single person or if you’re married as a married couple. We use a variety of insurance companies to provide you with guaranteed lifetime income. Only an insurance company can provide you a guaranteed lifetime income for yourself or you and a spouse, as long as you (or both of you) live. Guarantees are backed by the full faith and credit of the insurance company(s) selected.

Get it in writing

Get it in writing

When you work with us, we will craft a comprehensive retirement income plan together. Everyone we choose to work with receives a copy of their budget and a net worth statement. Using our Income For Life software, you will have a clear understanding of your income plan and how it works. If you become a client, we will give you a copy of your Income for Life report, your budget, your personalized written plan, and all plan documents organized in our Personal Financial Inventory Binder.

Conclusion:

Do you retire, or do you keep working? We help people find the best way to afford the ideal lifestyle they desire in their golden years. No matter what’s going on in the world, you want to make sure you can retire when you want and how you want, and to stay retired. An income folio is a structured income plan that can provide income stability and predictability, regardless of what is happening on Wall Street.

Retirement success isn’t massive growth in your assets. It is making sure your income runs smoothly for as long as you live. Would you consider that retirement success? Most people do.

Finally

The first step is to take stock of what you have and what you need. If you would like a complimentary review of your financial situation, e-mail us at info@incomefolios.com.

The Alway Rule

“For anyone retired or close to retirement, income is always more important than savings because savings can run out.” – Ed Slott, America’s IRA Expert.

Our Mission:

The make sure you do not run out of money in retirement.

Help you enjoy the retirement you deserve.

Isn’t this what you want for your retirement?

Where do you stand in preparing for retirement?

When you are working you are actually collecting a paycheck. You know that you have a steady stream of income coming in.

But at Retirement

When you go to retire, you usually have Social Security, maybe a pension, maybe a 401(k), 403(b) or another qualified retirement plan. You have to coordinate all that together so that you maintain that steady stream of income and are making that money last.

People are living longer and longer

Many people are not prepared and do not have a written plan. We develop a plan for them. We work with a lot of people and help them preserve their money in retirement. You need to think about safe returns, but more importantly, a protected income for life.

At Incomefolios, we help you with the tough questions like:

- How do I grow and protect my money?

- How do I maximize Social Security?

- How do I deal with the high cost of health care?

- Do I have enough money to retire on?

Contact us at info@incomefolios.com.